mortgage refinance transfer taxes

1 hour agoIf you refinance your mortgage closing costs typically range from 3 to 6 of the loan amount. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of.

Understanding Mortgage Closing Costs Lendingtree

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. But each lender will assess. For example Colorado has a transfer tax rate of 001 while people.

What are transfer taxes on closing costs. Transfer Taxes Transfer tax is at the rate of. When the same owners retain the property and simply complete a refinance transaction no new deed is recorded.

This time last week it was 438. March 23 2022 Rates are still inching up past 4 Molly Grace and Laura Grace Tarpley CEPF 2022-03-23T100000Z. Therefore no new deed transfer taxes are paid.

For example a homeowner who paid 2000 in points on a 30-year mortgage 360 monthly payments could deduct 556 per payment or a total of 6672 for 12 payments. That means a home that sells for 1 million is has a transfer tax of 14. The short answer is no real estate transfer taxes are not tax-deductible.

4 hours agoTodays mortgage and refinance rates. Ad Compare Refinance Options Get Rates Calculate Refi Payments. Unlike property taxes and mortgage interest you canât reduce your tax bill by deducting transfer tax.

0 percent to 2 percent. State Transfer Tax is 05 of transaction amount for all counties. Transfer taxes are not tax-deductible against your income tax but will afford a tax benefit to a purchaser or seller by increasing the basis of the property and thereby reducing the.

For a 300000 loan thats 9000 to 18000 in fees. Refinance transfer taxes refinance mortgage transfer tax florida florida transfer taxes for refinance florida mortgage refinance tax florida state mortgage tax florida transfer taxes. These are state- and municipality-specific taxes due to transfer the deed of the property in that.

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. It might also be added that apparently there is a. Transfer tax differs across the US.

5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of. In some states the transfer tax is known by other names. A property selling for.

Ad Compare Refinance Options Get Rates Calculate Refi Payments. A 20-year fixed-rate mortgage refinance of 100000 with todays interest rate of 444 will cost 629 per month in principal and interest.

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Newfoundland Land Transfer Tax Calculator 2022 Calculator Rates

What Are Real Estate Transfer Taxes Forbes Advisor

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Land Transfer Tax Home Quotes And Sayings Mortgage Quotes Refinance Mortgage

Mortgage Refinance Calculator Ratehub Ca

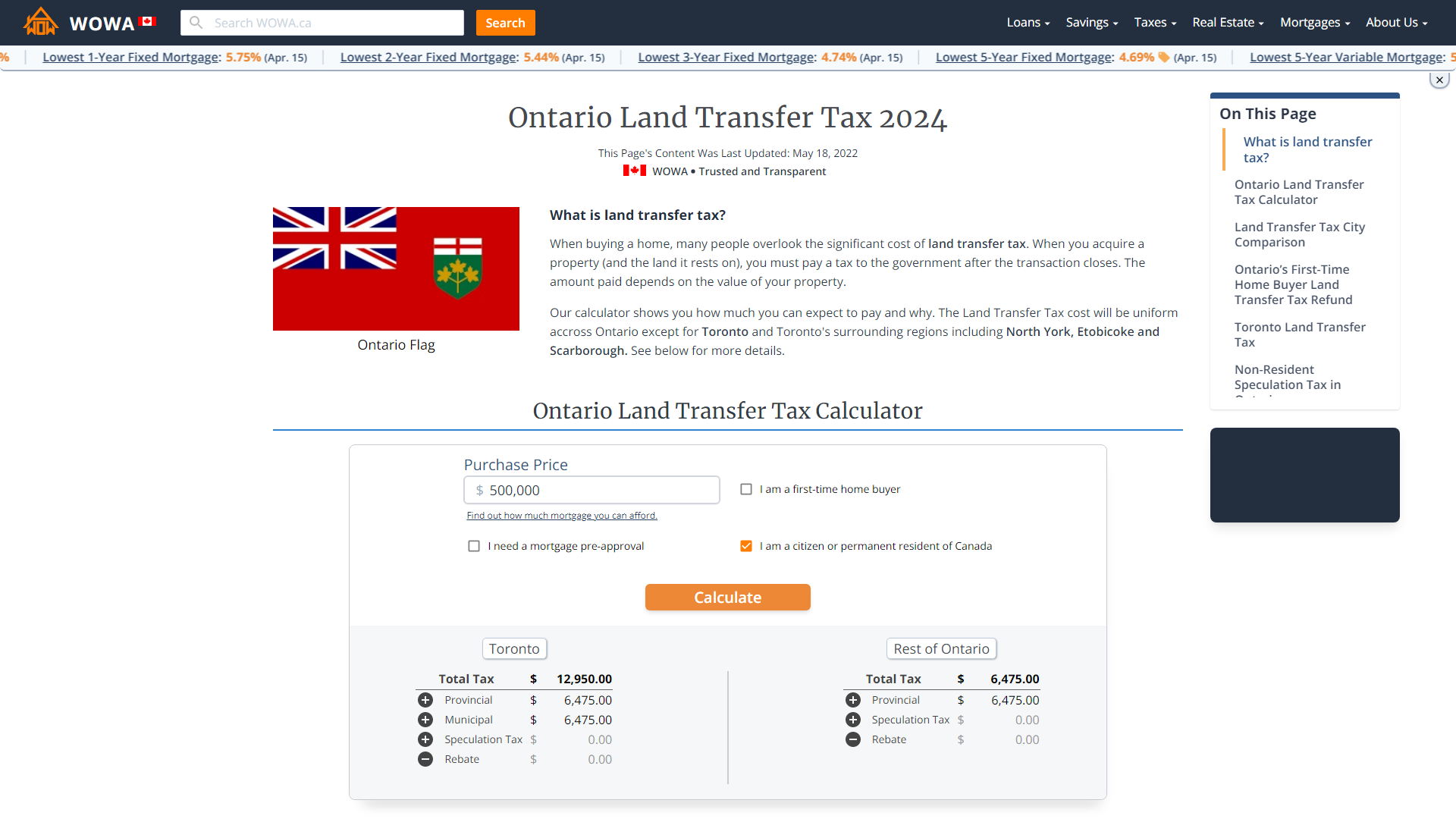

Land Transfer Tax In Ontario Ratehub Ca

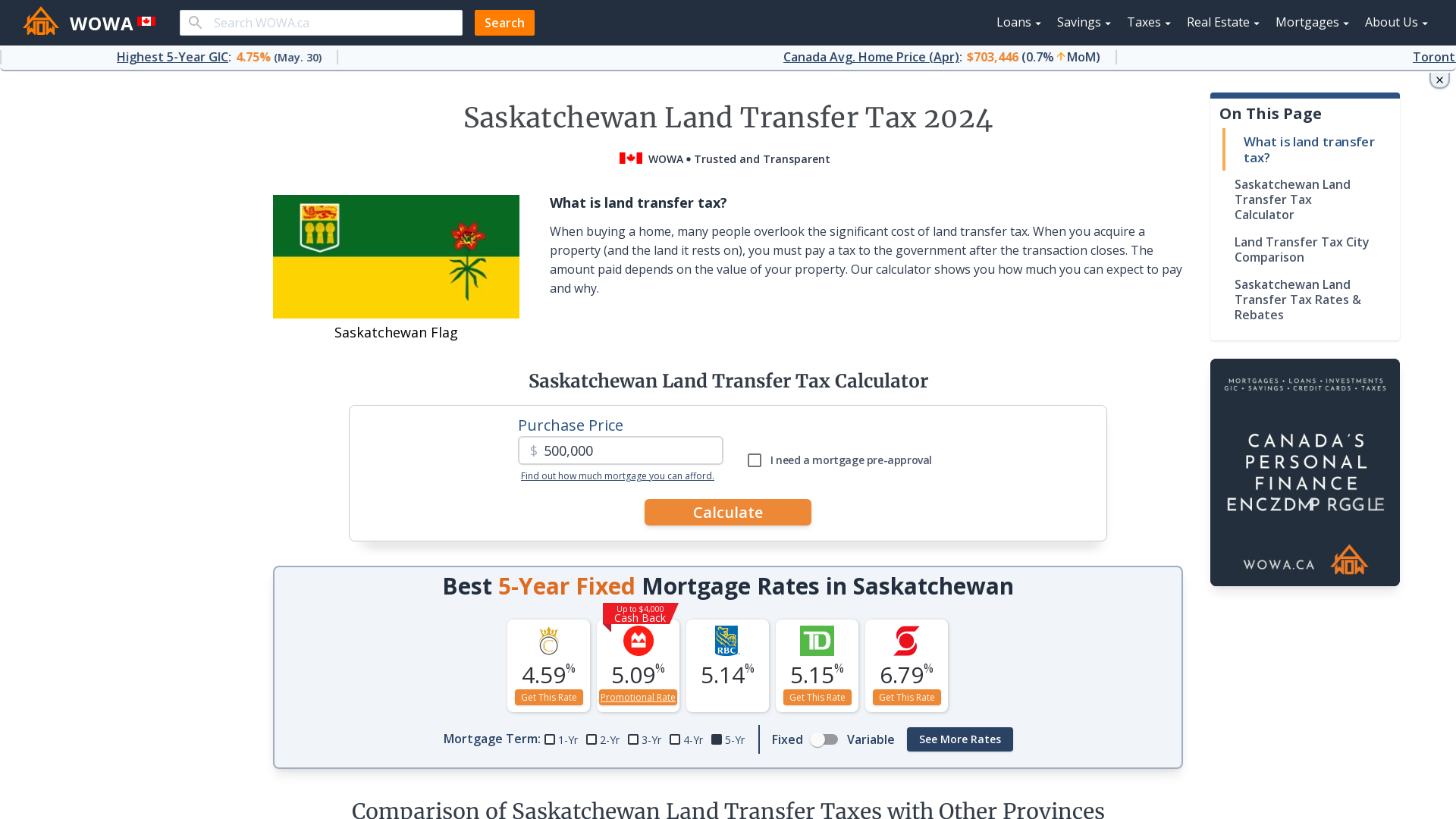

Saskatchewan Land Transfer Tax Calculator 2022 Wowa Ca

Alberta Land Transfer Tax Calculator 2022 Wowa Ca

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Canada Mortgage Refinance Calculator 2022 Wowa Ca

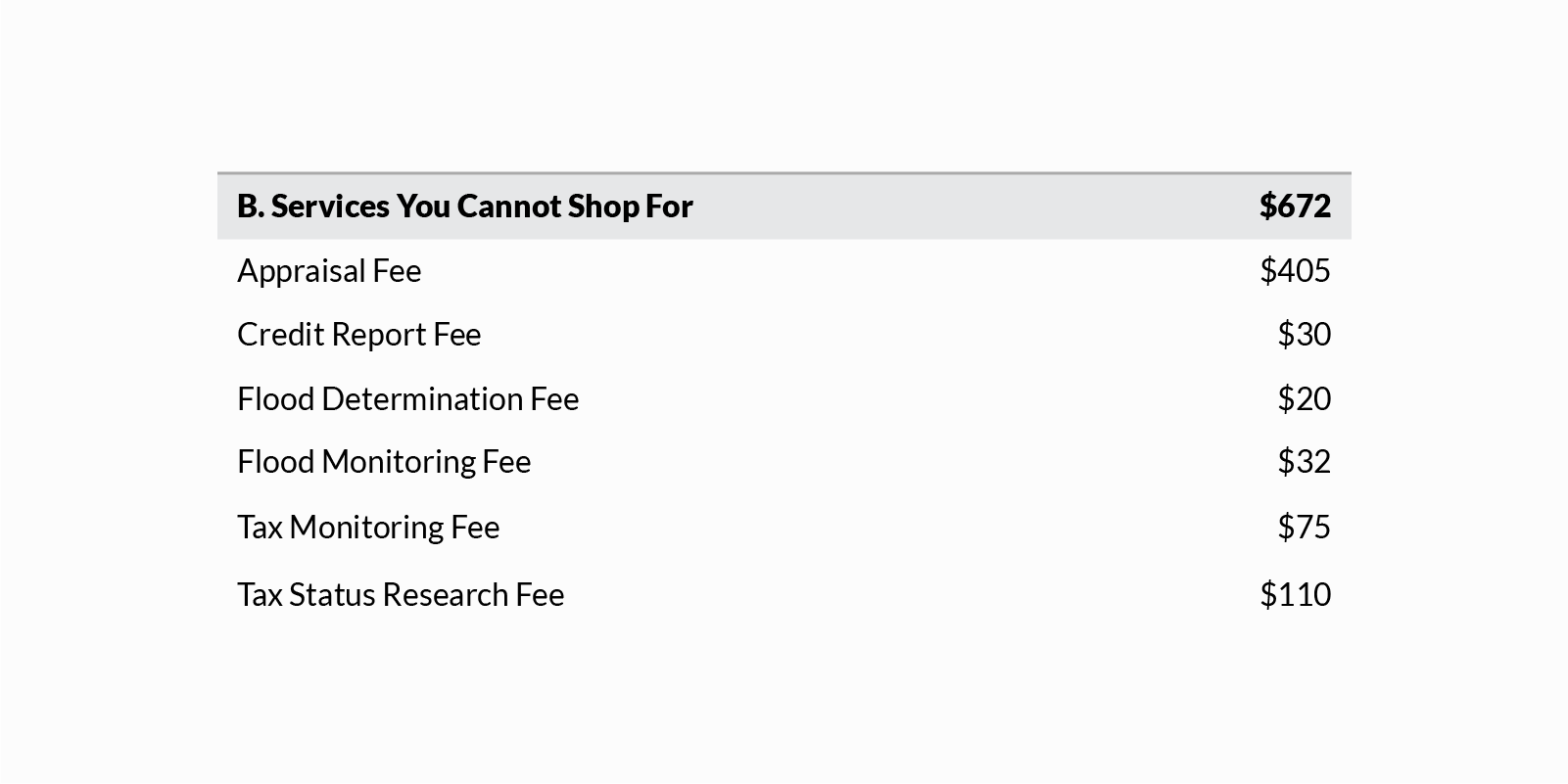

Closing Costs That Are And Aren T Tax Deductible Lendingtree

![]()

Closing Costs Ontario You Must Know Before Buying Or Selling Property