how to purchase stocks and bonds

As a result many investors may be wondering if its time to. To set up a Treasury Direct account you.

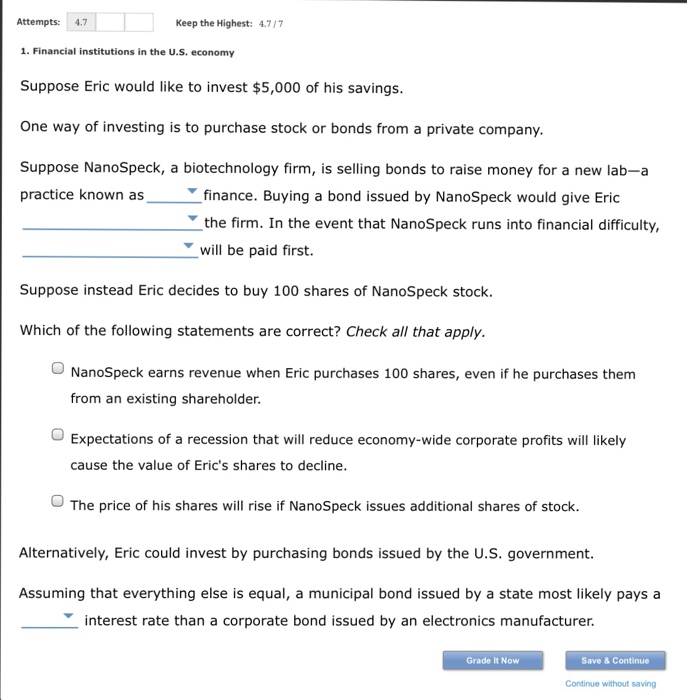

Solved Suppose Eric Would Like To Invest 5 000 Of His Chegg Com

Bonds are fixed-income securities that are in essence an IOU.

. Buying Bonds Through the US. How to Buy Stocks and Bonds. Stocks tend to make you the most money over long periods of time.

If you want to have a low-volatility bond portfolio you buy bonds with shorter. In general stocks are riskier than bonds simply due to the fact that they offer no guaranteed returns to the investor unlike. When buying bonds youll need to think about your purchasing.

Whether you go with individual. Online brokers perform offer investment-related links research and assets. And actually moderating how much risk you take is much easier in bonds than in stocks.

If you buy a 1-year bond the bank says Hey if you lend me 100 well give you 102 back in a year. And they pay interest to investors that. As with buying and selling stocks there are tax consequences associated with buying and selling bonds because of the income or gains you accrue with your bond investments.

Bond interest is usually paid twice a. The traditional portfolio of 60 stocks and 40 bonds has lost about 20 of its value year to date but most investment advisors recommend sticking with a balanced strategy. Between the lender or the person buying the bond and the borrower or the institution selling the bond.

The approximate current rate of return for a 2-year bond is. Bonds usually can be purchased from a bond broker through full service or discount brokerage channels similar to the way stocks are purchased. The stock market has taken some steep drops this month and forecasts of a correction or worse are mounting.

The only assistance an individual will usually obtain is technical assistance. A formal contract issued by a corporation. The first is to hold those bonds until their maturity date and collect interest payments on them.

You can buy new Treasury bonds online by visiting Treasury Direct. The investor will then purchase the bond at the issue price and Company A will pay the investor interest on the money paid for the bond. Stocks are beneficial for investors who have a.

There are two ways to make money by investing in bonds. It makes bonds much more illiquid and more difficult to buy and sell relative to stocks. Once the bond matures the.

A well-diversified portfolio means putting together a smart mix of stocks and bonds to balance potential risks and returns. Cons of Buying Stocks Instead of Bonds. Pros and Cons Bonds vs Stocks.

Terms in this set 9 bond. Owning both stocks and bonds is a basic concept of investing. You can narrow down stocks by looking at certain types of companies or by considering metrics like growth and volatility.

In a nutshell. Would-be buyers are forced out of the market as the monthly principal and interest payment for a new 30-year loan based on Freddie Macs figures has increased 53.

Difference Between Stocks And Bonds Ultimate Guide 2021 New

Marketwatch Learn How To Buy Stocks Bonds Mutual Funds Etfs Real Estate And Other Investments

Lesson 6 Stocks And Bonds How Companies Grow Pdf Free Download

Stocks Vs Bonds Top 7 Differences Between Stocks And Bonds

Bonds Vs Stocks Stocks And Bonds Finance Capital Markets Khan Academy Youtube

How To Invest In Bonds The Motley Fool

Stocks Etfs Mutual Funds Fidelity

Bonds Vs Stocks A Beginner S Guide Nerdwallet

3 Steps To Get Started When You Re Ready To Invest Principal

Learning About Business Buying Stocks Bonds

The Difference Between Stocks And Bonds Northwestern Mutual

Buying Stocks On Margin Is A Bad Idea You Could Easily Lose Everything

Bond Market Vs Stock Market Key Differences

Should I Invest In Stocks Or Bonds John Hancock

Start Investing In Stocks A Step By Step Guide For Beginners

Finding Individual Stocks And Bonds Vanguard